Up untill a week ago Nofrills carried these “three packs” of salmon for $10. Now the same pack contains two for the same $10. I thought it felt light when I bought it yesterday.

This comes to about $0.02 increase per gram, and a $1.10 price increase overall. Or a 11% increase in price overall. Meanwhile inflation is at 6-7%?!

The absurd thinness of the “family size” boxes of frosted mini wheats is another one.

They won’t be able to stand upright in the next round of shrinking.

The thing that pisses me off the most is “””eco-friendly””” companies doing shrinkflation. My guy, you can tell me it’s recycled plastic or whatever, if the portions are smaller you’re still pumping out more plastic than before, asshole.

I’d have more sympathy if this was something like peanut butter or eggs instead of smoked wild salmon.

deleted by creator

It’s consistently amazing to me that people have no idea how the money system works; it’s only the economics of the country, no big deal.

Ah yes, the US Fed causing inflation in all of Europe and Canada too. It’s crazy how the Fed made inflation lower here at home though. I don’t know how they do that without there being some kind of series of global supply shocks.

I guess we’ll never know.

deleted by creator

Lol yeah the person who replied didn’t know what nofrills was but the bank of Canada also increased total money supply similar to how the us federal reserve did.

I rarely get fast food but I’ve gone recently and I was shocked when I ordered a burger and got what would’ve been the junior version just a few years prior. Makes me wonder how tiny the junior version is nowadays.

It’s like ordering a Big Mac and getting a cheese burger

A Big Mac where I am is basically just a cheeseburger with lettuce, more bread and different sauce. The circumference is exactly the same and it’s using the same patties too.

Everybody blaming shrinkflation and nobody mentioning how terribly low salmon stocks are right now.

This is the first I’ve heard of this. What’s causing it?

Same reason for every animal resource: over exploitation of the resource, habitat destruction/pollution, and climate change. This isn’t a recent thing, salmon stocks have been declining over the last 4 decades. The response to this decline of course has been to continue extracting the same amount year over year.

Can someone please check on the salmon make sure they’re ok?

Atlantic Salmon populations have been doing fine and have an LC conservation status. Most of the issues with other salmon are in the populations off of the US West Coast.

Alaska has been seeing their populations increase in large part due to government hatcheries and wildlife management.

deleted by creator

Yesterday you gave me $10 and I gave you 3 hamburgers. Today you give me $10 and I give you 2 hamburgers but I still keep all 10 of your dollars. I blame it on inflation but in reality I’m just a greedy corporate fuck

200 g vs 255 g, bottom left

You have to stop buying them now. That’s the only way the prices will ever stabilize.

Buy less. Use less. Reward good pricing with your money. Spouse stopped buying favorite frozen sausages months ago because they went from $5 to $12. The other day noticed they are “on sale” for $5.25. Bought 2 and will continue buying them until they go back up. I’ve also started buying a lot of things on sale in bulk that will store awhile, so I can just walk by the ridiculous pricing until the next sale drops it again.

The old fish costs $3.92 per 100g, the new fish $5. That’s a price increase of (255/200 - 1) = 27.5%. The difference per gram (which isn’t of interest to anybody) is 5-3.92, i.e. ¢1.08. Which also equates to a (5/3.92 - 1) = 27.5% increase.

Not sure what you were calculating, but every result was wrong.

It’s 2 for the price of 3 - 50% increase

$3.33 to $5 is 50%

In pieces, sure. But the old pack contained 255g of fish and the new one contains 200g ;)

My bad thanks

Cost per gram is the only sensible measurement

and yet every single online grocery shopping I’ve been on refuses to have a filter or sort by price per weight option. It’s even more incredibly infuriating when you have to click into an item’s description or calculate it yourself, extra bonus hell points to the sites that change the weight metric so it’s an extra step to figure out what the actual comparison is (probably more a US problem with ounce/pound conversion).

I just wish the weights were consistent across similar products. I’ve seen some supermarkets where one brand uses cost per gram while another brand uses cost per 100 grams, and yet another brand uses cost per kg, all for the same product. Some toilet papers are cost per sheet, some are cost per 100 sheets, some are cost per roll. In the USA, one item might use price per ounce while the product next to it uses price per pound. Some packs of soft drink cans use price per can while others use price per 100mL or per fluid ounce.

Drives me crazy.

Price per roll has to be the worst seeing how rolls are different thicknesses

I know right? I’ll take a photo next time I see per roll unit pricing.

This is as designed. It’s like shopping for mattresses, they don’t want you to comparison shop.

Unit pricing is mandated in many jurisdictions, however many of them don’t mandate the specific units that are used. I wish they’d do that so that we could properly compare items.

The marketing law in Denmark does that. With few exceptions, everything must have the price displayed in the proper unit (liter, kilogram, meter, square metres or cubic metres) in addition to the price pr. item.

Who is gonna stop them? Nobody, so of course they’re pricing them above inflation. They’re there to make a profit, fuck you and yours and all that

Complaining about the price of Smoked Salmon, Oh the irony.

Traditionally, samon was considered a pauper food.

What’s the irony?

Are we assuming that since this person purchases smoked salmon that they’re immune to, ignorant of, or in favor of lower purchasing power? Are we assuming this is a luxury purchase, so they are not entitled to slumming it up with the rest of us?

Let this person just enjoy their fish, whatever little amount they’re getting for $10.

Exactly.

A little bit of prepackaged smoked salmon is not exactly a giant splurge.

Agreed. That dudes argument gives me avocado toast vibes.

LOL! Sometimes the avocados are on sale and we get more than we need. So, I decided to try this avocado toast thing everyone was talking about.

It is good stuff!

It’s just the cost of a banana!

For all we know this is their luxury buy of the month.

This sucks. One of my favorite places to eat has both inflation and shrinkflation. Higher price for smaller portions.

More than likely their suppliers are bleeding them, a lot of restaurants in my town are dealing with the same shit

Yeah. One of my favourite restaurants closed a couple months ago because they just couldn’t justify charging more for food, but their suppliers sure could.

It’s not the supplier “bleeding them” the supplier has the exact same problem the restaurant has, inflation, if they don’t raise the prices they go bankrupt. It’s a vicious cycle of everyone raising prices not to go bankrupt which causes everyone else to do the same.

You’re getting downvoted but the suppliers have suppliers too, and even if it’s a farm-to-table thing the farms have supply costs.

If you don’t think suppliers are using inflation to justify robber-baron price hikes, I guess you missed the part where companies are posting record profits.

I work for a packaging supplier and inflation is hitting us hard.

Perhaps the people whose job it is to know shit a actually do know shit

People will just tell you “Ah, that’s the excuse they gave you to not raise you to match the inflation”.

And we won’t and can’t know who’s right until we know who you work for and what’s their past and current financial output.

I know who is right because I’m not some bottom-tier employee parroting what I’ve heard. My job requires me to work with our finance team, M&A team, COO, and SG&A team as part of overarching strategy.

I’m an inflationary economist and I feel you, man.

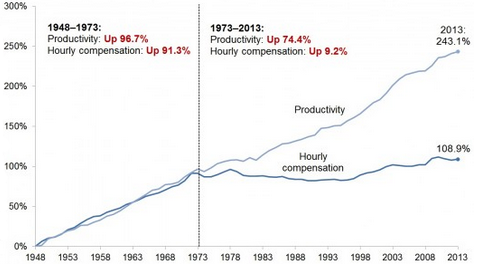

This concept of greedflation has been disproved in recent meta-analysis. It should probably die. I’ll copy paste a comment I wrote in some other thread analyzing it.

I think everyone should probably listen to this great report from NPR that dissects this issue. The Tl;dr: is greedflation is not really a real thing.

The deeper answer to your question of, “can one party increase prices in a market?” is sort of basic economics, and the answer is, “Usually, no.” In a competitive market, the answer is no. In a monopolistic market (meaning one company controls most of the market, think like Google with browsers) with no government oversight, the answer is yes. Things get complicated when you add in government regulation or oligopolistic markets (markets where only a few players control the market). In those cases, it depends on how strong government regulations on price-gouging are and any anti-monopoly or anti-anticompetitive practice laws are, and also depends on how oligopolists behave. Sometimes, particularly in industries with few big players, the big players will make the same decisions independently. If they do this cooperating it will usually violate antitrust laws, but if they both decide they’ll be better off say, not paying workers as much, or charging super high markups, them that can happen. A lot of economic research shows that kind of “tacit collusion” happens in real life, like in the oil and gas industries. But other times oligopolies will behave very competitively, only uniting through lobbyist trade groups if at all (think Microsoft and Amazon in cloud software).

So that’s the facts, but here’s my economic musing: The reason it feels like greedflation is a thing is a combination of factors:

- Inflation was very real, and very salient.

- Corporations (as mentioned in the NPR piece) crowed about their “record profits” in the short term, and also mention them when they are absolute record profits, not just record profit margins (something not mentioned but very real - a company can make twice as much money but also have spent twice as much, making way “more” money but with identical margins)

- In the US at least, we are seeing the highest numbers of industry consolidation and monopolies/oligopolies since the Gilded Age, so it feels like companies should be able to raise their prices if they want to.

- Media coverage and online spaces have become extremely polarized, so “corporations bad” is a very easy refrain to find if you’re watching or reading anything remotely left-wing, and it has been parroted by many democratic politicians as well, because it scores cheap and easy political points (also, and this is just my opinion, it helps vilify corps more in the public eye to help get more support for better antitrust legislation and enforcement, the actual end goal. I don’t think senators like Bernie Sanders don’t actually understand what’s going on with profit margins, I think they’re using it to generate political will, but that may be my own bias creeping in).

Huzzah for our current system of capitalism that insists a company is only doing good if each quarter has record profits. What’s bad with doing “good enough?”

Inflation drives all the numbers up. If money inflates to half the value but you maintain the same profit margins, you’ll make record profits despite the finances having functionally remained exactly the same.

Workers are also making record wages. It doesn’t mean much if you don’t consider how much the money is actually worth, as we’ve all been discovering over the last few years.

Workers are not making record wages, maybe CEOs and the upper middle class are but nobody else is. Maybe this is specific to America? Nearly everyone I know across multiple wage brackets I struggling with the cost of living.

I think that’s exactly it. I don’t know for sure, but these numbers may be average wages. And if that’s the case, having the top % or earners earn more while the bottome stays the same would still increase the average And would increase the divide between the top earners and bottom earners

Wage growth in the US has been most pronounced in the lower end of the market. Growth-oriented businesses like tech are a lot more sensitive to interest rate spikes, since their entire model is to borrow a ton of money to pay highly skilled workers a lot to “disrupt” an industry and achieve very rapid growth.

That isn’t necessarily contradictory with still struggling, since inflation exists. If you suddenly make 10% more money but everything costs 10% more as well, you are objectively making record wages, even though your buying power remains the same. Per that report, inflation-adjusted wages have actually grown on the lower end of the job market, so the average low-wage worker’s buying power has actually increased, but general statistics don’t always translate over to real-life experience super cleanly, and of course, a slight improvement from a bad financial situation doesn’t suddenly put you in a good situation.

so why not just lower the profit margins? also give me some of them record wages please, all I got was a bottle of champagne for all the work weve done and record profits but also raises in pay are frozen because of the turbulent times

You got champagne? All I got was runaround, brand new policies pulled out of thin air, and creative counting to deny seniority benefits. Turns out, I’ve worked for the same place 30 years when it inflates their retention and longevity numbers for the oversight agencies. I’ve also worked there for only a year (started a new position last year) when it suits them to deny a published benefit. The completely mindboggling part? These two countings were in the same email.

you got champagne? I just got lumped onto more projects for no more money

so why not just lower the profit margins?

Probably for the same reason you don’t casually decide to go to your boss and say that you voluntarily want a pay cut.

https://tradingeconomics.com/united-states/wages

Average hourly wage at the start of 2020 was $24. It’s now $29, which comes to about $10,000 more each year, and is an increase of about 21%. That growth has been concentrated in the service industry, but the data is pretty clear regardless, and the general trend applies to basically all sectors. Inflation in that same time period is 18.1%, so it simply is a matter of fact that the average worker has greater buying power today than they did in January 2020.

That’s an average, of course, and may not necessarily apply to you individually.

Every place I used to eat pretty much. And they cheap out on cheap shit too, like fries and rice. I used to work at a restaurant and the owner always taught me to fill up the sides cause it makes people feel they got their money’s worth

It’s like that episode of Next Generation “Remember Me” when the universe is shrinking and everyone’s disappearing and the Enterprise computer keeps gaslighting Dr Crusher trying to convince her it’s fine, everything’s fine, this is totally normal. But it’s not fine, it really isn’t.

I always check price/weight, and its increase has been ridiculous. For ones that don’t increase price also taste different, sadly. The best way to detect real value vs. price is look into nutrition tables but I don’t have the all database memorized lol so they’ll get away with it. :/